By Nicky Smith

April 22, 2025

As a candidate for Greensboro City Council District 4, I know some may say, “This is a county issue.” But let’s be real: Guilford County’s looming property tax spike is about to hit every one of us right here in Greensboro.

Whether you own a home or rent an apartment, the County’s revaluation—and the failure to commit to a revenue-neutral tax rate—will have a direct and painful impact on city residents. We can’t ignore it.

The County is about to reassess property values. Thanks to market trends, most homes will be appraised at significantly higher values. Now here’s the catch: if the tax rate stays the same, but your house is suddenly “worth” more, your bill goes up—whether you did anything or not.

That’s a tax increase in disguise.

According to the Rhino Times, this revaluation could raise property tax bills by as much as 47% in some cases. That’s not sustainable—not for middle-class families, not for seniors on fixed incomes, and not for young couples trying to build a life here in Greensboro.

Some think this is only about homeowners. It’s not.

When landlords are hit with massive property tax increases, they pass that cost directly to renters. That means higher rent for young professionals, families, and especially seniors—many of whom already struggle to afford safe, stable housing.

If we keep heading down this path, we’ll force people out of Greensboro into surrounding counties where taxes aren’t spiraling out of control. That’s not good for our city, our economy, or our sense of community.

It’s time for Guilford County leaders to commit to a revenue-neutral tax rate. That means lowering the tax rate to offset rising property values, keeping the total tax burden the same.

If we don’t demand this now, we’ll be left with another backdoor tax hike, just like we saw in 2022 when property taxes soared 25–30% for many families.

Even though the City Council doesn’t set the County tax rate, we must speak up. As your next City Councilmember, I will work with other leaders across jurisdictions to demand smarter budgeting, more accountability, and transparency for every taxpayer in Greensboro.

Here’s what we need:

✅ A revenue-neutral tax rate following the revaluation

✅ A full, independent audit of all county department budgets

✅ Protection for classroom teachers, not more central office administrators

✅ No new department expansions until existing budgets are reviewed

✅ More funding for emergency responders and public safety, not less

Our community is already stretched thin. Inflation is still high. Utility bills, gas, and food prices are up. And many Greensboro families are barely keeping their heads above water.

The answer is not more taxes. It’s a brighter, leaner, and more efficient government.

I’ve run successful businesses in Greensboro for more than 45 years. I’ve had years where we expanded and years where we had to cut back. That’s called responsible leadership.

Our local governments need to do the same. Before asking for more from hardworking families, they need to look within and spend smarter.

This is not just a budgeting issue—it’s a quality of life issue. It’s about whether people can afford to stay in the neighborhoods they love, whether young people can afford to stay in Greensboro. Whether our seniors can retire in peace.

The people of Greensboro deserve better. And I will fight every day to make sure your voice is heard.

Let’s build a city—and a county—we can all afford to live in.

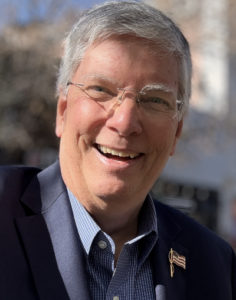

Nicky Smith

Candidate for Greensboro City Council, District 4