By Nicky Smith,

Candidate for Greensboro City Council District 4

August 19, 2025

When I bought my first home here in Greensboro thirty-five years ago, I never imagined I’d be writing a blog post about how property taxes are crushing families’ dreams of homeownership. But here we are – and frankly, I’m tired of watching our neighbors get squeezed out of their community.

Last month, I sat across from a young couple at a downtown coffee shop. They’d been saving for three years to buy their first home, and they finally had enough for a down payment. But when their lender ran the numbers, including projected property taxes, they realized they couldn’t afford the monthly payments. “We might have to move to High Point or Winston-Salem,” she told me, tears in her eyes. That conversation haunts me because I know they’re not alone.

Let me be blunt: runaway property taxes don’t just hurt current homeowners – they’re destroying the pathway to homeownership for an entire generation. When a young teacher or nurse considers buying a home in Greensboro and realizes that property taxes could increase by 40% or 50% with the next revaluation, they often walk away. They rent instead. They move to other cities. And we lose good people who should be building their lives here.

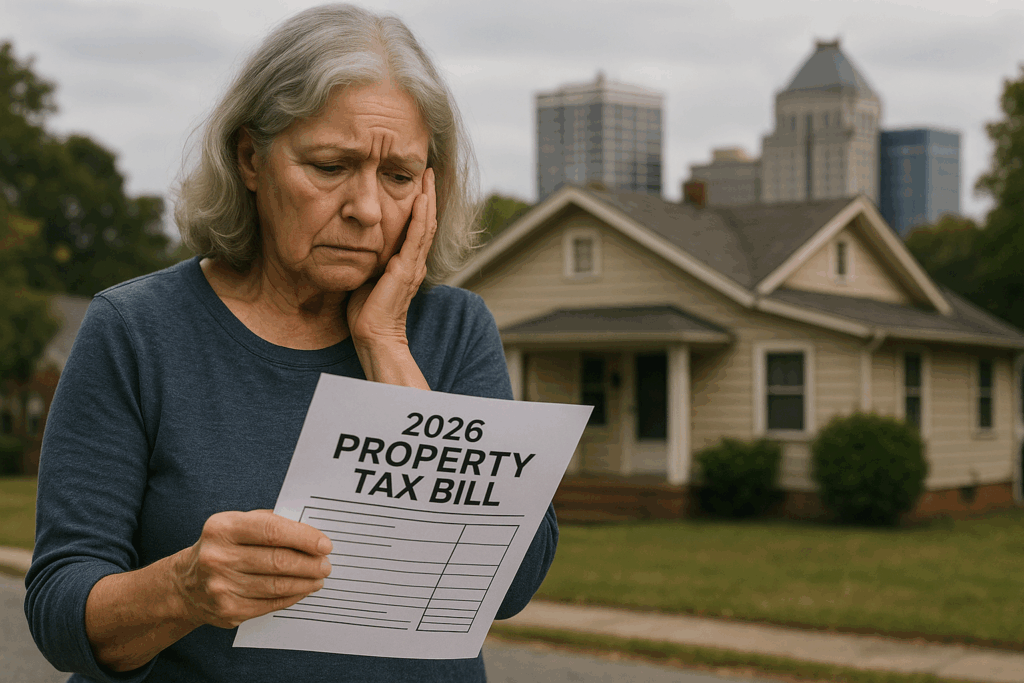

I think of a neighbor, an 82-year-old widow in my neighborhood who has lived in her house for forty-seven years. She raised four children there, buried her husband from that front porch, and now she’s considering selling because she can’t predict what her tax bill will be next year. When we tax people out of homes they own free and clear, we’re not just taking houses – we’re breaking apart the fabric of generational wealth that built the middle class in America.

My daughter, who graduated from UNC-Chapel Hill two years ago, asked me recently if she should even bother looking at homes in Greensboro. “Dad,” she said, “what if I buy a house and then can’t afford the taxes in five years?” I didn’t have a good answer for her then, but I do now.

I didn’t enter this race to be just another voice on City Council. I’m running because I have the business experience and relationships necessary actually to solve this problem. For the past 45 years, I’ve built coalitions, negotiated complex deals, and worked with elected officials at every level to achieve results. I know how to navigate the political process, and more importantly, I know how to bring people together around practical solutions.

Here’s what I learned in business that applies directly to this challenge: when you have a crisis, you don’t form committees to study the problem, you identify the solution and build the coalition to implement it. That’s exactly what I’ll do with property tax reform.

I’ve already begun reaching out to key legislators from both parties who represent our area. I’ve studied successful models from other states and identified the specific language needed for a constitutional amendment that will cap property tax increases while still funding essential services. This isn’t theoretical for me, it’s a concrete plan with real legislative partners ready to move forward.

Other states have figured this out, and North Carolina can too. We need a constitutional amendment that limits annual increases in assessed value for primary residences to no more than 3% or the rate of inflation, whichever is lower. This gives families predictability – they can budget, plan, and invest in their homes and communities without fear of being taxed out.

Think about what this means practically: a young family buying their first home would know their property taxes couldn’t spike beyond their ability to pay. A retiree could stay in the neighborhood where they raised their children. A small business owner wouldn’t face crushing increases on their commercial property that force them to close or move.

This isn’t about cutting services or hurting our schools – it’s about sustainable, predictable funding that allows families to build wealth and stay in our community.

Every month we delay action, we lose more families. Every revaluation cycle, we watch neighbors pack moving trucks. Every young person who gives up on homeownership in Greensboro is a future we’re throwing away.

The American dream has always been simple: work hard, save your money, buy a home, and build something for your children. In too many places across our country, that dream has become impossible for working families. I refuse to let that happen in Greensboro.

When my father bought his first house in 1954, he knew exactly what his monthly mortgage payment would be for the next thirty years. Shouldn’t families today have the same certainty about their property taxes? Shouldn’t a teacher, firefighter, or small business owner be able to plan their financial future without wondering if the government will price them out of their own home?

I’m not running for City Council to manage decline or make excuses about why we can’t solve problems. I’m running because I have the experience, the relationships, and the determination to fight for real property tax reform.

Within my first 100 days in office, I will convene a working group of regional legislators, present them with a concrete plan for constitutional reform, and initiate the process of building the necessary coalition to pass it. I will personally lobby every member of the Guilford County delegation and work with advocates statewide to make this a reality.

This is personal for me. I want my daughter to be able to afford a home in the city where she grew up. I want my neighbor to spend her remaining days in the house where she raised her family. I want that young couple I met downtown to come back and look at homes in Greensboro again.

Most of all, I want to preserve what has always made America special: the ability for working families to own a piece of the American dream and pass it on to their children.

That’s why I’m running for City Council. That’s why I need your vote. And that’s why we’re going to win this fight together.

If you’re tired of the status quo – tired of watching property taxes spiral out of control while our elected officials offer nothing but empty promises – then I need your support. Real change doesn’t happen by accident. It takes someone with the experience and determination to fight for working families, and it takes a campaign strong enough to get that person elected.

I’m asking for your vote, but I’m also asking for your financial support. Every contribution, whether it’s $25 or $250, helps us reach more voters who share our frustration with runaway property taxes. It helps us build the grassroots coalition necessary to demand action from our state legislators. Most importantly, it sends a clear message that Greensboro families are ready for leadership that will actually solve problems, rather than merely managing them.

If you believe that a teacher should be able to afford a home in the community where she works, if you think a senior citizen shouldn’t be forced to sell the house where she raised her family, if you want your children to have the same opportunity for homeownership that previous generations enjoyed – then join our campaign.

The choice is clear: more of the same failed leadership that has allowed this crisis to grow, or real solutions from someone with the experience to get results. I’m ready to fight for you. The question is: are you ready to fight with me?